Financial Stability and Independence Is A Top Retirement Goal, Say 35%

Financial Stability and Independence Is A Top Retirement Goal, Say 35%Retirement planning is a crucial part of everyone’s financial journey, not just for personal well-being but for the greater good of society. As people live longer, healthier lives, ensuring enough resources to support the golden years is important.

The first step in retirement planning is to set goals. Once you’ve set your goals, it’s time to start thinking about your finances. Retirement planning is about ensuring you have enough money to support yourself throughout the golden years. You must consider your income, expenses, savings, and investments. It may seem overwhelming, but with a bit of planning and maybe, a good financial advisor, you can find a financial plan that will take you through your retirement.

In this report, Real Research, an online survey app, analyzes the data collected from a survey on retirement planning. It focuses on the respondents’ retirement goals, income sources, and preferred payout plans. The survey was conducted among individuals from various age groups, income brackets, and locations. The findings offer a glimpse into the retirement planning trends and challenges individuals face in different regions and life stages.

Here are the key findings of the survey report:

- Over a third (34.08%) plan to retire below the age of 50

- The most (35%) commonly cited retirement planning goals are financial stability and independence

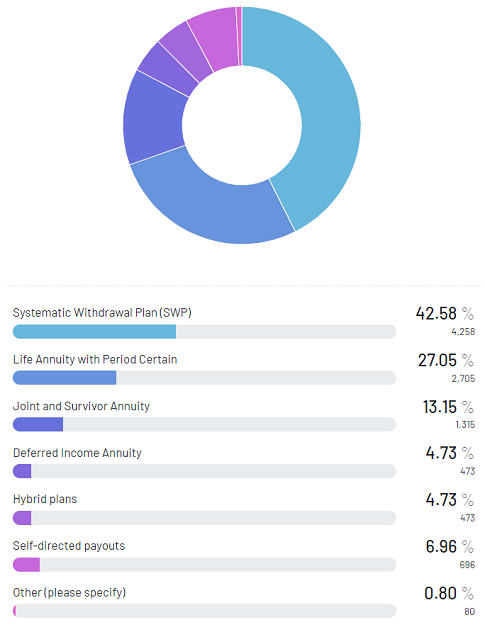

- The most popular (42.58%) preferred retirement payout plan is “Systematic Withdrawals”

Retirement Age and Goals

Firstly, it appears that a significant proportion of respondents plan to retire at a relatively young age, with over a third (34.08%) planning to retire below the age of 50. This is interesting, considering that the legal retirement age in many countries is higher.

Based on survey results, 27% reside in countries where the retirement age is 60-62. Moreover, another 15.51% and 10.01% reported having legal retirement age in their country at 62-64 and 64-70, respectively. In fact, only 39.7% of respondents reported a retirement age of below 60.

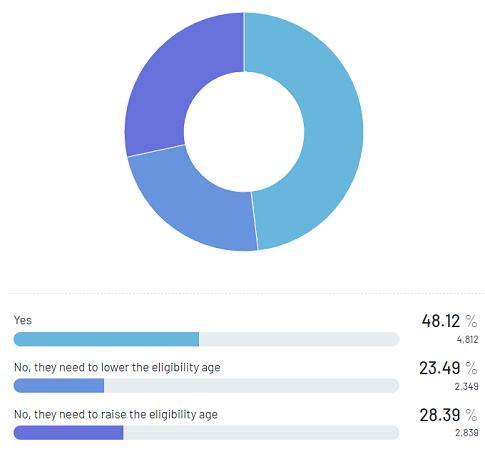

Notably, more than half of respondents were not satisfied with the current legal retirement age in their country of residence. In detail, 23.49% of respondents feel that the eligibility age should be lowered, while 28.39% think it should be increased.

Post-retirement Income Sources

Additionally, financial stability and independence during retirement (35.12%) was the most commonly cited goal for retirement planning. This goal was followed by adequate savings for healthcare expenses (18.64%) and maintaining a desired lifestyle (11.42%).

Respondents also generally placed retirement planning as a high priority, with nearly two-thirds (61.08%) reporting it as their highest or high-priority financial goal. However, there were still a small proportion (3.12%) of respondents who did not prioritize retirement planning at all.

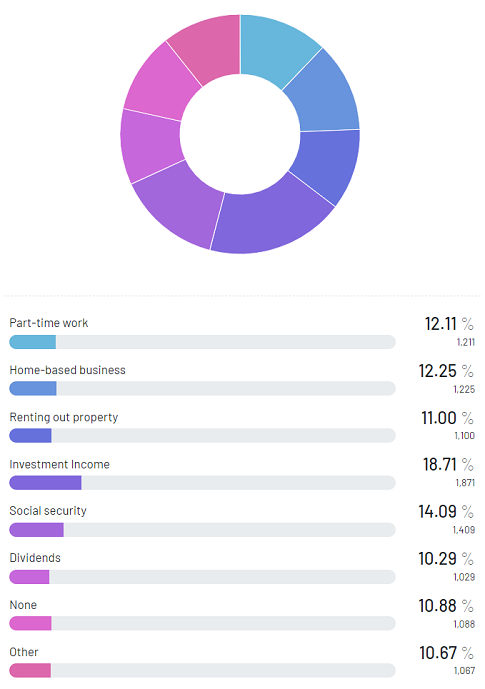

Regarding alternative sources of income during retirement, investment income (18.71%) and social security (14.09%) were the most commonly considered options. A minority of respondents also expressed interest in part-time work (12.11%) or starting a home-based business (12.25%).

Retirement Payout Plans

Approximately 41.33% had reached out to a financial planner regarding their retirement planning, while 22.27% plan to do so in the future.

Finally, the most popular preferred retirement payout plan was Systematic Withdrawals (42.58%), followed by Life Annuity with Period Certain (27.05%) and joint and survivor annuity (13.15%). Regarding their satisfaction with the current retirement plan, almost a third of respondents (29.59%) were highly satisfied, while only a small percentage (1.64%) expressed dissatisfaction.

Conclusion

Overall, the survey suggests that retirement planning is a significant concern for many people, with a focus on financial stability and independence. While many respondents appear to be taking proactive steps to plan for retirement, there may be room for improvement in understanding legal retirement requirements and exploring alternative income sources.

Methodology | |

| Survey Title | Survey on Retirement Planning |

| Duration | February 12 – February 19, 2023 |

| Number of Participants | 10,000 |

| Demographics | Males and females, aged 21 to 99 |

| Participating Countries | Afghanistan, Algeria, Angola, Argentina, Armenia, Australia, Azerbaijan, Bahrain, Bangladesh, Belarus, Benin, Bolivia,… Brazil, Brunei, Bulgaria, Burkina Faso, Cambodia, Cameroon, Canada, Chile, China, China (Hong Kong) China (Macao), China (Taiwan), Colombia, Costa Rica, Croatia, Czech Republic, Ecuador, Egypt, El Salvador, Ethiopia, Finland, France, Gambia, Georgia, Germany, Ghana, Greece, Greanada, Guatemala, Honduras, Hungary, India, Indonesia, Iraq, Ireland, Israel, Italy, Ivory Coast, Japan, Jordan, Kenya, Kuwait, Kyrgyzstan, Latvia, Lebanon, Libya, Lithuania, Malaysia, Maldives, Maluritania, Mexico, Moldova, Mongolia, Morocco, Mozambique, Myanmar [Burma], Namibia, Nepal, Nicaragua, Nigeria, Oman, Pakistan, Palestine, Panama, Peru, Philippines, Poland, Portugal, Qatar, Romania, Russia, Saudi Arabia, Serbia, Sierra Leone, Singapore, Slovakia, South Africa, South Korea, Spain, Sri Lanka, Tanzania, Thailand, Togo, Tunisia, Turkey, Turkmenistan, Uganda, Ukraine, United Arab Emirates, United Kingdom, United States, Uruguay, Uzbekistan, Venezuela, Vietnam, Yemen, Zimbabwe. |

RR Author

Real Research News is the media platform that presents insights and studies of wide-range of topics. It focuses on insights gathered from its survey app.